how much is vehicle tax in kentucky

The Powerball jackpot is a record 204 billion. In the case of new vehicles the retail price is the total.

Vehicle Registration Renewal Vehicle Registration Renewal Drive Ky Gov

Registration Renewals Motorcycle.

. When you move to Kentucky you will need to register your vehicle at the county clerks office within 15. Kentucky boasts a 5 state tax which would take 3 million out of the yearly payout or more than 46 million of the lump sum leaving you with a payout total of 1103111340. December 14 2021 by Bridget Gibson.

November 7 2022 657 AM PST. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. The state tax rate for non-historic vehicles is 45 cents per 100 of value.

Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. For vehicles that are being rented or leased see see taxation of leases and rentals. How much is property tax on a car in Kentucky.

The average effective tax rate for the county is 094. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Assuming a top tax rate of 37 heres a look at how much youd take home after taxes in each state and Washington DC if you won the 19 billion jackpot for both the lump.

It is levied at six percent and shall be. For more information or questions about Motor Vehicle fees call. Non-historic motor vehicles are subject to full state and local taxation in Kentucky.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. On used vehicles the usage. The state tax rate for non-historic vehicles is 45.

A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. On our projection report I think it was about 140 million Cathey Thompson the Department of Revenue State.

The national average is around. Beginning July 1 2020 but prior to July 1 2024 a fee is hereby imposed upon a retailer at the rate of 2 for each new motor vehicle trailer or semitrailer tire sold in Kentucky. For vehicles that are being rented or leased see see taxation of leases and rentals.

Highway use tax of 3 of vehicle value max. Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. The vehicle sales tax in Kentucky is 6 on all car sales and there are no additional sales taxes by city or county.

The state tax rate for historic motor vehicles is 25 cents. The state in which you live. The state tax rate for non-historic vehicles is 45.

In addition to taxes car. Every year Kentucky taxpayers pay the price for driving a car in Kentucky. How much is tax on a car in Kentucky.

Registration Renewals Car Non-Commercial. Historic motor vehicles are subject to state taxation only. Clearly the higher your car is valued the more taxes you pay.

The following registration fees apply to vehicles in Kentucky. Once you have the tax rate. Historic motor vehicles are subject to state taxation only.

Since it directly impacts their revenue from taxes they set the sales tax rate based on their own financial conditions and other influencing factors. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. Does a trade-in reduce sales.

Winners will be hit with a massive tax bill if they live in these states. On used vehicles the usage tax is 6 of the current average. Non-historic motor vehicles are subject to full state and local taxation in Kentucky.

Wait This Is A Thing In Kentucky I Like How It Was Mailed To The Dealership From A County We Don T Live In And Not Knowing Till Now R Kentucky

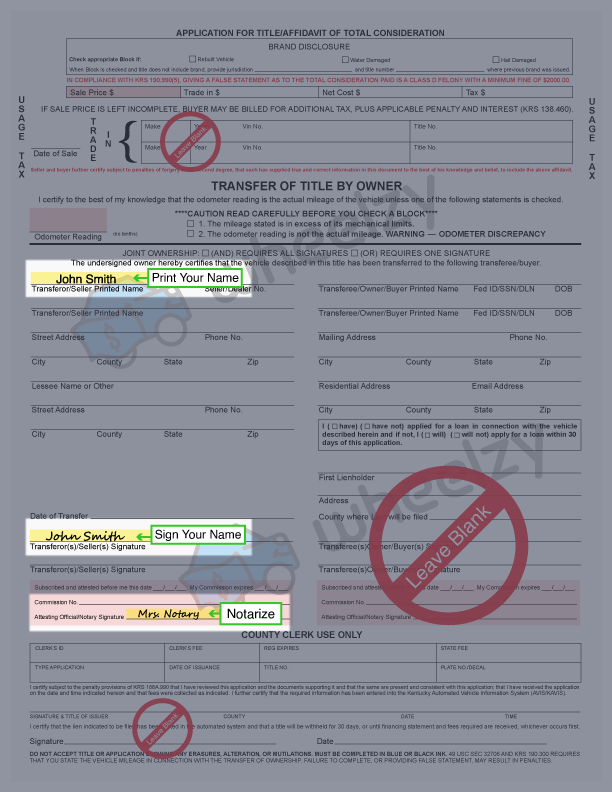

How To Sign Your Car Title In Kentucky Including Dmv Title Sample Picture

Why Are Kentucky Car Tags So High This Year Lexington Herald Leader

Lawmakers Concerned Over 40 Increase In Motor Vehicle Tax Rates News Kentuckytoday Com

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

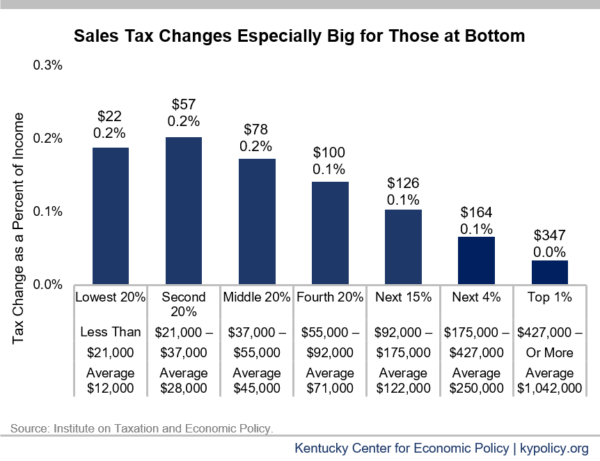

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Senate Approves House Bill On Vehicle Tax Relief Fox 56 News

Kentucky Used Car Prices Taxes Jump 40 Start 2022 Fox 56 News

Kentucky S Gas Tax Is Failing To Keep Up With Road Funding Needs

Vehicle Tax Reimbursements Will Hit Mailboxes Beginning Next Week Wkdz Radio

/cloudfront-us-east-1.images.arcpublishing.com/gray/2LO2KAYFXFC4FATDWJUPQE23QQ.png)

Gov Beshear Vehicle Property Tax Relief Provided Temporary Sales Tax Cut Needed To Combat Higher Prices

Kentucky Vehicle Valuations Increase By 40 Here S What You Can Do If Your Car S Value Jumps This Year Span Class Tnt Section Tag No Link News Span Wpsd Local 6

Rising Value Of Vehicles May Lead To Property Tax Increase In Kentucky News Wdrb Com

Kentucky Transportation Cabinet Na Twitterze Do You Have A Personalized Kentucky License Plate If So Note That All Personalized License Plates Will Transition To A Birth Month Expiration Beginning January

Kentucky S Car Tax How Fair Is It Whas11 Com

Beshear Announces Vehicle Property Sales Tax Relief Proposal

Beshear Proposes Sales Tax Decrease

Group In Frankfort Wants Kentucky Lawmakers To Establish An Electric Vehicle Tax In 2022 Session Clayconews